All about Analytics, Risk Management and Risk Technology that impacts Financial Services, Banks, Technology Companies, you and me...... and more..

Monday, May 25, 2020

Economic impact of COVID-19 – The hard lessons

Wednesday, November 6, 2019

Enhancing Credit Risk Management

The popular saying “the only thing that is constant is

change” applies to the way lenders use technology and scoring solutions to

understand the creditworthiness of applicants. Credit Risk Management has come

a long way from the days when banks used one credit score cut off to decision

loan applications. Risk managers now have a plethora of solution options to

craft a credit policy that hits the right balance between risk and reward.

Traditional vs.

Alternative Data Defined

Traditional data typically refers to data that credit

bureaus maintain on their files. This includes data from loan applications,

credit lines, loan repayment history, credit inquiries, and public information

like bankruptcies. Traditional data is FCRA compliant and the acid test is that

it must be verifiable and disputable by the customer.

Industry research has shown that scoring solutions that

use traditional data cannot score a significant section of the population.

According to the Consumer Financial Protection Bureau (CFPB), these ‘credit

invisibles’ number over 45 million people1. It further

points out that although this segment of the population may not have a regular

loan payment track record, they may still be paying their other bills

regularly. And for this reason, it is very important to track this payment

history – e.g. utility payments – to estimate their credit risk.

Definitions of alternative data may vary, depending on

where you look. But in a broad sense, it pertains to data that includes, but is

not limited to rent payments, mobile phone payments, cable TV payments as well

as bank account information, such as deposits, withdrawals or transfers.

The Pros and Cons of

Alternative Data

While alternative data has a very important role in

financial inclusion, it also has other important benefits. In addition to

improving the assessment of the risk of the customer, it can provide timely

information to lenders on activities that may not be reflected on bureau data.

Further, it enables lenders to provide enhanced customer experience. For

example, when they share an online bank account, the loan application

processing may be faster.

Like traditional data, alternative data is susceptible to

inaccuracies. Consumers may not be able to readily review and correct

alternative data although the standards governing it are constantly changing

and evolving to meet customer and regulatory expectations.

## Risk Intelligence #CreditRiskManagement #AlternativeData #Bank #CreditCard

Tuesday, October 1, 2019

Serving Everyday America: Products and Services for the Non-Prime Market - #Lend360

I had the opportunity to participate in the #Lend360 event in Dallas, Texas (Sep 25 – 27 2019) as a speaker. It was a great event that focused on online lending industry, especially Fintechs, with over 800 lending professionals and sponsors in attendance.

I was a member of the panel on “Serving Everyday America: Products and Services for the Non-Prime Market”. I spoke on how #Alternativecreditdata enables lenders to understand and reach their customers in three big ways.

Alternative Credit Data is now being used by prime as well as non-prime lenders to book new customers. By using a host of new generation Fair Credit Reporting Act (FCRA) approved credit risk solutions, lenders can now understand their customers better and hence tailor products and services accordingly. Alternative data is also a key component that can help expand #Financialinclusion initiatives to deliver financial services to the hitherto unserved sections of society.

In my discussions I highlighted the following three -

1. The US has an estimated 53 million adults who are outside the purview of traditional credit bureaus. It is now well known that alternative data can identify and score approximately 90% of this population

2. Secondly, alternative data enables lenders to differentiate between consumers with similar traditional credit bureau profiles. This is because it can provide granular segmentation and a 360 degee view of applicants that is possible only when we use FCRA compliant not-tradeline data.

3. Thirdly, from an acquisition perspective, whatever segments the lender targets using alternative data, for the same risk – or charge offs – alternative data is capable of booking more accounts.

Tuesday, July 16, 2019

Will Financial Inclusion make India a US$5 trillion economy?

Many may think that this might be a tall order for a country that till recently was home to the largest number of utterly poor in the world. But the truth is that India may be closer to this target than we may realize.

While all sectors of the economy have to grow rapidly, the financial services sector has a key role to play to reach the mark. By stepping up its inclusive program that provides equal access to loans and other financial services to all sections of society, it can create a multiplier effect.

The obvious link here is that when a larger number of people borrow, especially the poor, increased economic activity follows leading to growth in sustainable means of income for broader sections of society. This, then helps rupture the “vicious cycle” of poverty.

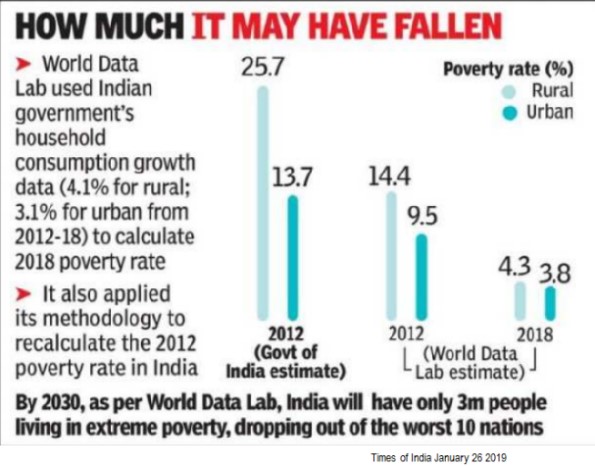

Despite all this, India’s progress had obviously been slow in the past. But the economic fortunes of the poor have changed for the better – quickly and noticeably – only in the last decade. A report published in the Times of India (TOI) in January 2019 quoting World Data Lab showed the steep fall in poverty in India and estimated the current ‘extreme poor’ to be around 50 million.4 [According to the World Bank, ‘extreme poor’ are those who make less than $1.9 per day.]

It is important to see the declining poverty levels in the context of the massive digital revolution that is taking place in India in parallel. Contrary to what the electronic and print media in India may have you believe, the digital revolution on multiple fronts has aided and catalyzed the financial inclusion programs of the government.

As of December 2018, 1.23 billion people had Aadhar digital biometric identity cards5 and over 1.21 billion had mobile phones.6 Also, as of 2017, 80% of adults had a bank account .7 Bulk of the new accounts were opened with the aid of Aadhar identity cards.

Further, the country has also seen steep rise in mobile payment transactions. According to the data released by the National Payments Corporation of India (NPCI) 8 transactions via the Unified Payments Interface (UPI), the country’s flagship payments platform, grew 25% and crossed Rs.1 trillion in value in December 2018.

However, millions continue to live in poverty. India has a low credit access with only 154 loans per 1000 adults7. This may be attributed to the reluctance of lenders to lend to people whose credit worthiness cannot be reasonably assessed. Unlike the US, India does not have robust credit reporting agencies with depth of data that can help lenders in approving loans. This remains a major challenge for credit expansion.

The good news, however, is that the confluence of mobile penetration, establishment of a biometric identity and the emergence of disruptive credit risk solutions that facilitate the identification and assessment of borrower risk may set the scene for massive credit inclusion process. Consequently, India’s efforts to eliminate poverty may have reached a tipping point.

Many fintechs around the world and in India are now using a consumer’s digital identity to predict loan repayment behavior. In a report published in September 2018, the Federal Deposit Insurance Corporation (FDIC) of the US has reported9 that a predictive “model that uses only the digital footprint variables equals or exceeds the information content of the credit bureau score”.

In other words, lenders in India will now be able to assess credit risk of borrowers by using their digital identity. This also simultaneously obviates the need to build credit bureaus using traditional data – an expensive and time consuming effort in any case.

The purpose of this piece is not to speculate if India will reach the US$ 5 trillion mark by 2024-25, but to rather assess its preparedness in setting in motion a host of services and programs that will benefit the largest number of poor. As is obvious, lifting millions of people out of poverty is a multi-pronged, multi-mission driven exercise where the happy meeting of cutting-edge technology and robust political will to execute the mission are necessary and imperative conditions.

India has adequately demonstrated its capability to execute complex projects on time and within budget. This augers well for the extreme poor. If they rise up above poverty, so will India, economically speaking, and crossing the US$ 5 trillion mark may just be one of the milestones.

Modi’s achievements in this regard, as substantiated by data from multiple sources, are substantial and suggest that it is broad-based and truly inclusive. This is in stark contrast to the efforts of the earlier government led by Dr Manmohan Singh who claimed at the National Development Council that “the first claim on the country’s resources for development”10 were reserved exclusively for a particular religious community.

It is indeed debatable if India, in its tryst with destiny, ever managed to redeem its pledge, as Pandit Jawaharlal Nehru dreamt at that midnight hour in 1947. Definitely data suggests that even after almost six decades, the redemption of the pledge in terms of poverty eradication, was not even substantial. But given the track record of the last five years, Modi’s tryst with India is taking it places and the poorest of poor are joining the bandwagon in their millions. And Modi has the backing of the state-of-art technology. Of course, the claim on the country’s resources for development will be inclusive and for all, not the exclusive right of a select few.

References

1.Goal to make India $5 trillion economy by 2024 challenging, but possible, says PM Modi

https://www.businesstoday.in/current/economy-politics/goal-to-make-india-5-trillion-economy-by-2024-challenging-but-possible-says-pm-modi/story/356407.html

2.Annual Policy Statement for the Year 2005-06 by Dr. Y. Venugopal Reddy, Governor, Reserve Bank of India

https://rbi.org.in/scripts/BS_ViewMonetaryCreditPolicy.aspx?Id=2217#1

3.Rangarajan Committee submits report on financial inclusion

http://archive.indianexpress.com/news/rangarajan-committee-submits-report-on-financial-inclusion/257905/

4.New data may show big cut in number of poor

http://timesofindia.indiatimes.com/articleshow/67705787.cms?utm_source=contentofinterest&utm_medium=text&utm_campaign=cppst

5.Number of Aadhar Card holders in India

https://en.wikipedia.org/wiki/Aadhaar

6.Number of Mobile phones in use by country

https://en.wikipedia.org/wiki/List_of_countries_by_number_of_mobile_phones_in_use

7.Strategy for New India @ 75 – NITI Aayog

https://niti.gov.in/writereaddata/files/Strategy_for_New_India.pdf

8.UPI transactions rise 25%, cross Rs 1 trillion mark in December

https://www.business-standard.com/article/economy-policy/upi-transactions-rise-25-cross-rs-1-trillion-mark-in-december-119010100767_1.html

9.On the Rise of the FinTechs—Credit Scoring using Digital Footprints

https://www.fdic.gov/bank/analytical/cfr/2018/wp2018/workingpapers-2018.html

19.Minorities must have first claim on resources: PM Manmohan Singh

https://economictimes.indiatimes.com/news/politics-and-nation/minorities-must-have-first-claim-on-resources-pm/articleshow/754218.cms

Monday, March 25, 2019

The emergence of alternative data in Financial Inclusion

Is The Post Pandemic US Recovery Sputtering?

N ow that the vaccines for the deadly Covid-19 virus are in place, there is expected relief all over. The big question in the minds of most ...

-

Article posted SmartData - B2C - Analytic Bridge W e all live in a digital world or rather ‘social digital’ world. This is be...

-

N ow that the vaccines for the deadly Covid-19 virus are in place, there is expected relief all over. The big question in the minds of most ...